|

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

ROLEXROLEXROLEXROLEXROLEXROLEX

|

|

|

|

#1 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

As a consumer, my goal isn't trying to rip off a dealer...its getting the best deal that I see as being mutually agreeable. Its the same in any negotiation. You should stop reading your books on becoming a negotiator because it makes you sound like a business professor that only preaches because they couldn't hack it in the real world. Your $100M deals seem to have gotten to your head. I never implied that I am the best negotiator. I said people think they get the best deals by paying cash. In my business and personal life, cash and terms are the same. In fact, my business prefers terms because we do make money on the back end since we hold the note. But since you feel the need to throw out your career highlights, I just closed a deal with the Veteran Health Administration worth $167M... Just another day at the office Your original post was flawed and I pointed it out. Now you're on a rampage to prove me wrong which has yet to happen. So since you're hell bent on showing us all how free credit isn't free, please show us because I'm getting bored. |

|

|

|

|

|

|

#2 |

|

"TRF" Member

Join Date: Nov 2011

Location: Illinois

Watch: Blue Sub TwoTone

Posts: 130

|

Rob,

Renato has shifted the conversation to CREDIT CARDS and still says it doesn't matter. He's the best and knows he can get the same deal cash or charge because of his sheer force of will. To which I gave my factual analysis above. |

|

|

|

|

|

#3 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

I'm still on the 0% issue. As a side discussion, I pointed out how cash isn't king and I merely stated cash doesn't do anything to help a deal. I had a hard enough time staying awake to read your first post. I can't imagine where this is going next. You want to argue net 15 vs net 30? NPV? IRR? Good grief, chill out |

|

|

|

|

|

|

#4 |

|

"TRF" Member

Join Date: Feb 2010

Real Name: Rob

Location: Bucks County, PA

Watch: Batman

Posts: 472

|

Ahhh. I do agree that the AD does take a hit with a CC.

__________________

Found my TT Bluesy 116613 from and AD! Next.... |

|

|

|

|

|

#5 |

|

"TRF" Member

Join Date: Mar 2011

Real Name: Bryan

Location: Pacific Northwest

Watch: YG DD lchdp

Posts: 2,963

|

From a certain point of view, they don't take a hit with the CC, but instead, make more with cash.

It depends on where you draw the initial line. economics and finance don't mix, mostly because nobody has ever figured economics, ever... ok, maybe a little, but we still live in a world with paper money, so they didn't figure out much! |

|

|

|

|

|

#6 |

|

Member

Join Date: Oct 2010

Real Name: Chuck

Location: Seattle

Watch: Rolex Submariner

Posts: 256

|

I've dealt with only two AD's. The first offered 15% off and no payments or interest for 5 months, but full amount due (had to sign up for their card though, no big deal). The other AD had me at full retail price, 20% down and 12 equal & no interest payments for 12 months (again, had to get a store credit card). I had the money up front in either case, but the arrangments did ease cash flow issues. Interesting & in-depth thread though, but since Rolex is an emotional purchase, as most luxury goods are, people will generally not go to the depths of thought presented. But thanks to all for your input. Cheers!

|

|

|

|

|

|

#7 |

|

"TRF" Member

Join Date: Sep 2011

Location: WA state

Watch: EXP 39mm

Posts: 278

|

0% is 0% ! When you buy a car at 36,48,60 month terms and don't make the payments they repo your car and the bank sends you a bill for there loss. Credit card fees we eat to make the deal but limit it to 5k.

Renato, I think your spot on Sir cash is not always king of the deal. |

|

|

|

|

|

#8 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

|

|

|

|

|

|

|

#9 |

|

"TRF" Member

Join Date: Sep 2010

Real Name: Charles B

Location: GMT -7

Watch: Hulk 116610LV

Posts: 6,131

|

__________________

Hulk 116610LV + GMT II 126710 BLNR + Explorer 124270 + Air King 126900 + Submariner 16613LB |

|

|

|

|

|

#10 |

|

"TRF" Member

Join Date: Feb 2012

Location: Wisconsin

Watch: Franken

Posts: 437

|

|

|

|

|

|

|

#11 |

|

"TRF" Member

Join Date: Feb 2012

Location: Wisconsin

Watch: Franken

Posts: 437

|

Remember this thread when someone tells you they have our banking crisis all figured out. |

|

|

|

|

|

#12 |

|

"TRF" Member

Join Date: Oct 2009

Location: USA

Watch: Not enough ;-)

Posts: 21,232

|

Why financing ?

Save money, pay cash and receive a nice discount. With todays interest rates you can buy your wife a nice second hand Rolex . . . . . for free ! I wouldn't do it. |

|

|

|

|

|

#13 |

|

"TRF" Member

Join Date: Sep 2011

Location: Canada

Posts: 6,773

|

Some people would prefer to believe that 0% financing is possible rather than consider the possibility that it`s not and it would appear that to that end the number "zero" has the power to hypnotize certain unthinking minds.

"Most men would rather die than think." (Bertrand Russell:philosopher,logician,mathematician,histori an and social critic,18 May 1872 - 2 February 1970) |

|

|

|

|

|

#14 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

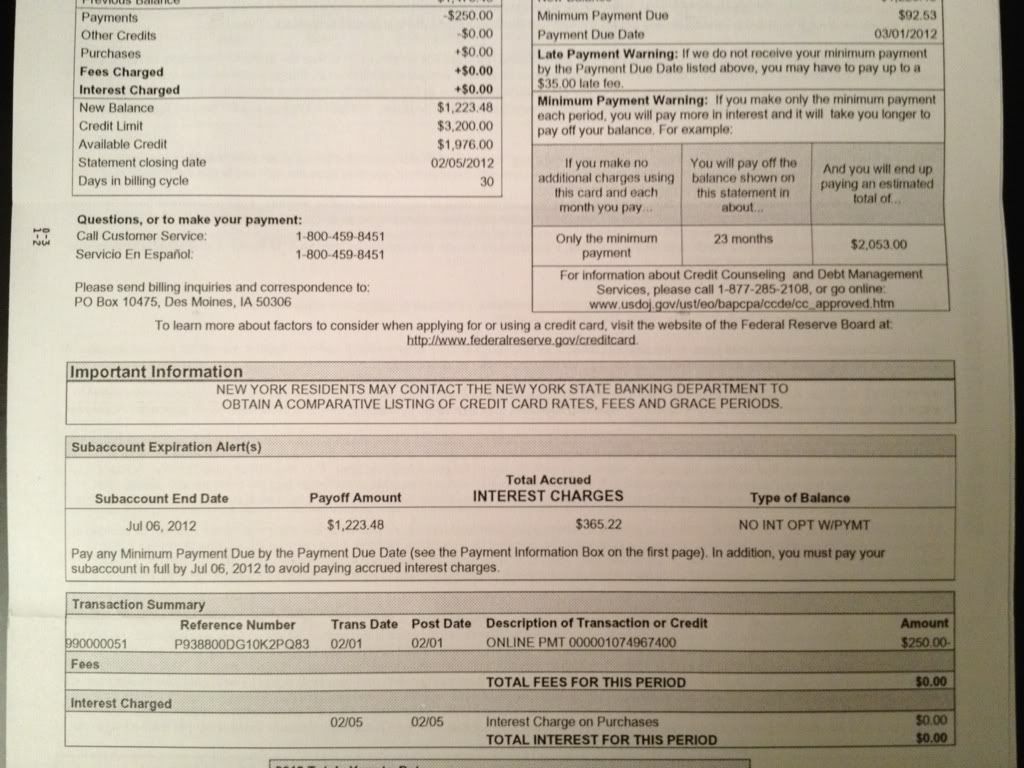

Here's a copy of my latest statement from Brookstone using 0% financing to buy a massage chair. Show me where I'm paying one penny in any kind of fee above a cash transaction I'll help you out... look at the sub account info where you will see it clearly stated "...you must pay your sub account in full by Jul 06, 2012 to avoid paying accrued interest" It looks like the only one not thinking is you

|

|

|

|

|

|

|

#15 | |

|

"TRF" Member

Join Date: Sep 2011

Location: Canada

Posts: 6,773

|

Quote:

|

|

|

|

|

|

|

#16 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

So using your logic, that means if you pay cash, you're paying for the financing as well without using it So essentially, you would have to be even dumber to pay cash. Congratulations, you've become the poster boy on the importance of education. I'll make sure to tell my kids to read your posts as a reminder of what happens when you dont go to college |

|

|

|

|

|

|

#17 |

|

"TRF" Member

Join Date: Jul 2010

Location: Scotland

Watch: Milgauss GV

Posts: 1,201

|

|

|

|

|

|

|

#18 | |

|

"TRF" Member

Join Date: Nov 2011

Location: Illinois

Watch: Blue Sub TwoTone

Posts: 130

|

Quote:

|

|

|

|

|

|

|

#19 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

If you consider Michigan a bottom tier school, you aren't as bright as you think. Oh, I also went to a top tier boarding school too. Got anything else? |

|

|

|

|

|

|

#20 | |

|

"TRF" Member

Join Date: Sep 2011

Location: Canada

Posts: 6,773

|

Quote:

|

|

|

|

|

|

|

#21 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

My dog has a a stronger argument against walking in the rain than you've had with the 0% financing. Instead of trying [unsuccessfully] to keep up it, read some of the responses and it might, MIGHT make sense. |

|

|

|

|

|

|

#22 |

|

"TRF" Member

Join Date: Nov 2011

Location: Illinois

Watch: Blue Sub TwoTone

Posts: 130

|

I was chatting with a friend this morning about some of these discussions and a couple guiding themes came up that are cause for much of the disagreement.

1. The first thing they'll teach you in Micro Economics is that there is no fee, tax or cost of business that doesn't get passed on to the customer. There are no free rides. Hence, when you buy a polo shirt at Nordstrom's for full retail ($79) you're paying for their lease per square foot, their highly paid sales staff, floor displays, advertising, financing and other costs. When you buy that same polo shirt for $34 at CostCo you're paying that price because of no customer service, no credit cards permitted, no helpful sales consultant, self service checkout, no packaging and cheap square footage. If you didn't focus on Econ these variables don't register in your purchases. 2. If you're accounting focused, you are typically focused on the time value of money and a retroactive review of the opportunity costs of money. Accountants love low priced finance options for that reason. Accountants do not understand negotiations, they under stand the time value of money. 3. People that believe they are paying the same price cash or credit might be right, but it is only right because they are buying their wares from the lowest levels of management. The further up the management chain you negotiate, the more sensitive they are to the costs of finance and the more likely you are to get a better value for cash or shorter terms. While not the topic of Rolexes, this is well illustrated by the Finance and Insurance Guy that posted (F&I car guy). I buy my American cars for cash, new from the dealer. I've never had a dialogue with a F&I guy in the back room because I deal with the general manager / owner and I leverage spiffs from the manufacturer. I always pay cash but then again I also pay 30% to 35% off of list as was the case with my two relatively recent purchases. A F&I guy or a salesman doesn't care about these things but the owner does. Hence, if cash or credit doesn't matter I'm talking to the wrong layer of management. |

|

|

|

|

|

#23 | |

|

"TRF" Member

Join Date: Jul 2010

Location: Scotland

Watch: Milgauss GV

Posts: 1,201

|

Quote:

1: Even with a cash discount from an AD all your points in #1 will be factored in. 2: I know a few and this is true lol! 3: When your talking about five digit and up amounts of £/$ and especially with car dealers(hips) then cold hard if you can for sure will net you a better score. Last edited by witch watch; 2 March 2012 at 03:17 AM.. Reason: Fat fingers |

|

|

|

|

|

|

#24 | |

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

To be honest, I think we're closer to agreeing that disagreeing Lets cut through the BS here. We all know that businesses are there to make a profit. The difference between gross profit and net profit is the cost of doing business. I'm not disputing that the costs are passed on to the customer, in a basic sense, but it isn't universally the same across the board based on expense and sometimes, the business takes a hit on margin in order to do business. If I walk into a small pet store in NYC, I can expect to pay more than if I did the same in Des Moines however if I walk into the GAP on 5th Ave., I can expect to pay the same price as I would at the GAP in Wichita even though the cost of keeping the doors open on 5th ave is 4x's more. Nobody negotiates prices Best Buy, Toys R US or Brookstone and you pay the price as marked. All of these stores offer 0% financing at least a few times a year. If you buy a $1000 camera from Best Buy and pay cash and I buy the same exact $1000 camera but use their 0% financing, we both end up paying the same amount. Assuming there is a fee that Best Buy pays to the credit provider, there is a difference on how much we paid for the same camera. I'm not arguing that the credit company does not charge fees to the retailer, I'm arguing that there is no fee passed on to me. Thus making it a a free loan. |

|

|

|

|

|

|

#25 | |

|

"TRF" Member

Join Date: Nov 2011

Location: Illinois

Watch: Blue Sub TwoTone

Posts: 130

|

Quote:

We're close, but there is a difference in our comparison in a couple ways. Yes, you will pay less for GAP in Des Moines than you will for GAP on 5th Ave, NYC. You'll pay less because regional promotions and in-house sales are targeted to offset the less-desirable shopping experience in Des Moines. They'll also try to adjust true cost to purchase (coupons, mailers, incentives) to increase demand in Des Moines by lowering costs. Best Buy is a better example of our difference in opinion. You state you cannot haggle at Best Buy but their products are not unique, and they exist at other locations where you can indeed get the same product for less and not absorb their costs of location, staff and finance. (e.g. Abt electronics, New Egg) To the point of Rolex, I guess that's where we have the defining difference in my strategy and others. I won't go to a Rolex dealer that is so large, located in a very expensive piece of real estate, or that has a financing arm because I don't wish to absorb those costs into my purchase. I go to large ADs that are "not too big, not too small" and I deal with the owner on a cash basis. That's how I get a DSSD for 17.5 pts off and I get a LV Hulk for 20 pts off. It's not that I'm a better negotiator at the time in place compared to you per se, it's that I've picked a suitable target (my ideal AD) and a suitable layer of management (the owner that actually pays the 3% CC fee) as the focus of my negotiation. |

|

|

|

|

|

|

#26 | ||

|

Liar & Ratbag

Join Date: Nov 2009

Real Name: Renato

Location: NYC / Miami Beach

Watch: Rolex Daytona

Posts: 5,344

|

Quote:

Quote:

|

||

|

|

|

|

|

#27 |

|

"TRF" Member

Join Date: Feb 2012

Location: Wisconsin

Watch: Franken

Posts: 437

|

Since you used Best Buy as an example, I know how much Best Buy gets charged for their financing and I know how they build it into their pricing. It's always there and it's always a cost of their ENTIRE inventory. Let's say you find a sweet deal for $500 (no difference if it is cash or credit) on something that usually costs $700. It's because they are dumping inventory rather than writing it off at an even bigger loss.

BUT, they WOULD have priced it at $490 if they didn't have the cost of their financing program and credit card fees. And trust me it's a big a$$ number. It's always there. Everybody paid an extra $10 across the board whether you believe it or not. You, the consumer, didn't notice it because you got a great deal. You saved $200 and wouldn't have any idea there was another $10 on the table if you could wave a wand and make financing go away. It's just deeper then "the price is the same". It's accounting. When I hear about "cash rewards" or "0% financing" or "travel rewards" I think to myself how much that just cost me as a cash buyer. And there is not a damn thing we can do about it. So go ahead and finance it with Best Buy when you find a great price because yes, it is the same. But if you found a cash only dealer in the same inventory situation at the exact same time with the exact same profit motive, you could save $10. Okay, the end for me on this. Last edited by Lmbeauleap; 2 March 2012 at 06:58 AM.. Reason: spelling |

|

|

|

|

|

#28 | |

|

"TRF" Member

Join Date: Sep 2011

Location: WA state

Watch: EXP 39mm

Posts: 278

|

Quote:

2.I think your wrong about a better deal with the owner/gm. It's funny when we get those deals his FRIENDS end up paying a little more money.  3. who buys a car today off list or MSRP ? there is a true cost for everything we buy and just saying but I'm starting there.

|

|

|

|

|

|

|

#29 |

|

"TRF" Member

Join Date: Apr 2011

Location: San Fran

Watch: SS Daytona

Posts: 385

|

can we get this thread closed out? Seriously this is out of control and the back and forth is stupid. If any of you would like, call me, I will put you in touch with someone that will put this topic to bed. VP of GE Capital on the consumer credit side. Let me know who wants to talk with him and get the straight answer and not this back seat financing.

|

|

|

|

|

|

#30 |

|

"TRF" Member

Join Date: Feb 2012

Location: Wisconsin

Watch: Franken

Posts: 437

|

You are seeing this from the point of the consumer. Instead, think like the share holder. Nothing gets ever gets subtracted from margin. They START with the end margin goal and work backwards adding all the costs on top until they get to the end pricing you pay. Think about it this way. Before credit cards, lets say company "X" had 8% ROI. Do you think all their investors just settle for 5% average return now? Or did they gradually raise prices a couple percent as plastic fees kicked in over the years?

Best Buy knows exactly how many people use plastic or financing and how much it costs so they just average it all out and add in X% for everything from CD's to TV's. That always comes in under MSRP because the manufacturers also know this number. The check the retailer sends the manufacturer, or the "invoice" if you will, is all that matters. Last edited by Lmbeauleap; 2 March 2012 at 09:29 AM.. Reason: spelling |

|

|

|

|

| Currently Active Users Viewing This Thread: 1 (0 members and 1 guests) | |

|

|

*Banners

Of The Month*

This space is provided to horological resources.